Maybank Discover boundless financial opportunities through Maybank’s personal loan solutions. Embrace a future of prosperity with our competitive rates and lightning-fast approvals. Don’t miss out,...

Kuwait Finance House

Discover the gateway to financial freedom with Kuwait Finance House’s Murabahah Personal Financing-i Generic. Offering up to RM250,000 in financing with flexible tenures ranging from 2 to 10 years, this innovative solution empowers you to pursue your dreams without the hassle of guarantors. With competitive rates, Shariah-compliant principles, and easy payment methods, embark on your journey to financial empowerment today.

Murabahah Cashline-i

Kuwait Finance House (KFH), a leader in Shariah-compliant banking, presents the Murabahah Cashline-i, a promotional offer designed to cater to your immediate cash needs with unparalleled flexibility and convenience. Explore the top key features and benefits of this innovative financial solution tailored to meet your diverse requirements:

Top Key Features and Benefits

- Flexible Withdrawal: Access instant cash without touching your existing deposits or investments, providing you with the extra financial flexibility you need.

- No Minimum Monthly Payment: Enjoy the freedom of no minimum monthly payment requirements. You only pay profit charges on the amount you utilize, settling the full amount within the agreed timeframe.

- Competitive Pricing: Benefit from competitive pricing structures, ensuring cost-effectiveness and value for your financial transactions.

- Shariah Concept – “Murabahah Tawarruq”: This financing solution adheres to Shariah principles, ensuring ethical and transparent financial practices.

- High Margin of Advance: Avail a high margin of advance, empowering you with greater borrowing capacity to meet your financial obligations.

Account Benefits

- Flexible Cash Withdrawal: Access cash anytime via cheque, Debit Card, ATM, or at any of our branches, ensuring convenience and accessibility.

- No Guarantor Needed: Enjoy hassle-free borrowing without the need for a guarantor, simplifying the application process.

Fee Structure

- Brokerage Fee: Proportionate as per the financing amount.

- Stamp Duty: 0.5% of the financing amount.

- Takaful: Determined based on customer’s profile (age, gender, tenure, etc.), providing comprehensive coverage and protection.

Eligibility Criteria

- Age Requirement: Individuals aged 21 years old or up to 2 years before retirement age (60 years old).

- Residency: Malaysian residents.

- Asset Ownership: Own any permissible assets acceptable to KFH Malaysia, free from any encumbrances.

- Purpose: For personal use or short-term working capital.

- Tenure: Minimum of 2 years and up to 5 years, subject to annual review.

- Financing Amount: Minimum of RM5,000 and a maximum of RM250,000, ensuring flexibility to meet various financial needs.

Required Documents

- Salaried Earners: Latest 3 months’ payslip, latest EPF Statement showing the latest 3 months contribution, and other documents on a case-by-case basis.

- Own Business: Latest B/e-Tax form with tax payment receipts or EPF statements showing at least 6 months contribution or a copy of the latest Audited Financial Statements, Business Registration Form, additional documents such as latest 6 months Company bank statement, or Proprietor bank statement and latest 3 months Personal bank statement, and other documents on a case-by-case basis.

Murabahah Financing-i Generic

Kuwait Finance House (KFH) introduces the Murabahah Personal Financing-i Generic, the next evolution in personal loan solutions. Discover the top key features and benefits of this innovative financial product designed to empower you towards your goals:

Top Key Features and Benefits

- Up To RM250,000 Financing: Access financing of up to RM250,000, providing ample funds to fulfill your diverse financial needs.

- 2 to 10 Years Tenure: Enjoy flexible repayment tenures ranging from 2 to 10 years, allowing you to tailor your repayment schedule to suit your financial capabilities.

- Competitive Financing Rates: Benefit from competitive profit rates, ensuring affordability and value for your borrowing needs.

- Shariah Concept – “Murabahah Tawarruq”: This financing solution operates on the Murabahah Tawarruq concept, adhering to Shariah principles and ethical financial practices.

- No Guarantors Necessary: Simplify the borrowing process with no requirement for guarantors, streamlining your application and approval process.

Lifestyles

Whether you’re planning for a dream wedding, a long-awaited vacation, or funding a startup venture, Kuwait Finance House’s Murabahah Personal Financing-i is the ideal solution to kickstart your plans.

Account Benefits

- Flexible Tenure: Enjoy flexible financing tenures from 2 to 10 years, providing convenience and adaptability to your repayment schedule.

- Takaful Protection: Gain total peace of mind with “Takaful” protection, ensuring comprehensive coverage for unforeseen circumstances.

- Easy Payment Methods: Make repayments hassle-free through Interbank GIRO (IBG) or Interbank Fund Transfer (IBFT), ensuring convenience and accessibility.

- No Early Settlement Penalty: Enjoy the flexibility to settle your financing early without incurring any penalty charges, empowering you to manage your finances on your terms.

Fee Structure

- Brokerage Fee: Proportionate as per the financing amount.

- Stamp Duty: 0.5% of the financing amount.

- Takaful: Determined based on customer’s profile (age, gender, tenure, etc.), ensuring comprehensive coverage and protection.

Eligibility Criteria

- Confirmed and Permanent Staff: Employed with multinational companies, public limited companies, government-linked companies, and their subsidiaries.

- Age Requirement: Individuals aged 21 years or up to 2 years before retirement age (60 years old).

- Residency: Malaysian residents with a minimum gross monthly income of RM3,000.

Required Documents

- Salaried Earners: Latest 3 months’ pay slip, latest EPF Statement showing the latest 3 months contribution, and other documents on a case-by-case basis.

- Own Business: Latest B/e-Tax form with tax payment receipts or EPF statements showing at least 6 months contribution or a copy of the latest Audited Financial Statements, Business Registration Form, additional documents such as latest 6 months Company bank statement, or Proprietor bank statement and latest 3 months Personal bank statement, and other documents on a case-by-case basis.

Coshare KFH 3.88%

Discover the all-new Personal Loans Coshare KFH 3.88%, a premier financing option in Malaysia. Launched amidst the challenges of the Covid-19 pandemic, this financing solution addresses the economic impact of the Movement Control Order on individuals. Anticipated to gain popularity among AG government civil servants, this offering underscores Kuwait Finance House’s reputation for leading financing packages tailored for government employees.

Before applying for a personal loan with Coshare KFH at the special interest rate of 3.88%, it’s crucial to understand the specific criteria involved. Here’s a detailed breakdown of the requirements and terms:

Loan Criteria Overview

Special Interest Rate

- Interest Rate: 3.88% flat rate for Personal Loans Coshare KFH, representing one of the lowest rates available in the market for flat rate loans.

Loan Terms

- Payout: 80% of the loan amount.

- Processing Time: Typically 7-10 working days.

- Loan Period: Minimum of 2 years and maximum of 15 years of financing, with the first-time loan period being extended.

Financing Details

- Minimum Amount: RM10,000.

- Maximum Amount: RM200,000.

- Loan Type: Unsecured loan.

- Single Customer Limit: RM200,000.

Applicant Requirements

- Employment: Applicants must be in a permanent position and have served at least 1 year from the date of appointment.

- Minimum Salary: The minimum starting salary required is RM3,000.

- Eligibility: Open to full government staff (AG Only), including all federal government employees. Police personnel are also eligible to apply.

Exclusions

- Ineligibility: This promotion, namely Personal Loans Coshare KFH 3.88%, is not open to state government employees and statutory bodies (GLC).

Retirement Financing

- Financing Period: Financing is available up to one year before retirement. If the applicant chooses the 60-year retirement option, calculations are done until 59 years old.

Important Note

- Debt Service Ratio (DSR): Applicants with a high DSR are NOT ELIGIBLE to apply. The scheme does not consider CCRIS and CTOS records. Applicants must disclose any commitments outside of pay slips, such as credit cards, house or vehicle installments, personal loans paid through bank account deductions or bank-in, and others.

Please click here to get the details of Coshare KFH JCL Criteria Personal Loan

KFH 3.88% 100% Payout

The moment you’ve been waiting for has arrived – Kuwait Finance House, in partnership with Coshare, is offering a groundbreaking personal loan opportunity with a remarkable 100% payout. With this exclusive offer, you can access the full loan amount upfront, providing you with immediate financial freedom to pursue your goals and dreams.

What’s more, the interest rate for this unparalleled offer is an incredibly low 3.88% per annum, ensuring affordability and peace of mind throughout the repayment period. Whether you’re looking to consolidate debt, cover unexpected expenses, or invest in your future, this deal provides the perfect solution to meet your needs.

But act fast – this exceptional offer won’t last forever. Seize the opportunity today to take control of your finances and secure a brighter financial future. Don’t let this chance pass you by – apply now before it’s too late!

Advantages

If you’re considering applying for a personal loan from Kuwait Finance House in 2022, here are the advantages you can enjoy:

- Competitive Profit Rates: Benefit from highly competitive profit rates, set at only 3.88% flat rate. This ensures affordability and ease of repayment throughout the loan tenure.

- Maximum Financing Amount: Access financing of up to RM200,000, providing you with ample funds to meet your financial needs and goals.

- Flexible Financing Period: Enjoy flexibility in choosing your financing period, ranging from 2 to 10 years. Tailor the repayment schedule to suit your financial situation and preferences.

- Fresh Loan Eligibility: Kuwait Finance House welcomes fresh loan applications, allowing you to access financing even if you haven’t previously borrowed from them.

- Overlap Loan Encouraged: Customers interested in overlapping their loans are encouraged to apply. This option provides additional flexibility for managing your finances effectively.

- Payment via Salary Deduction: Streamline your loan repayments with the convenience of salary deduction, ensuring timely payments without the hassle of manual transactions.

- Easy Documentation: Experience a hassle-free application process with easy documentation requirements, making it convenient to apply for and obtain your personal loan.

Cost of Living

- Cost of Living: RM1,000+

- Total Income < RM3,000: Debt Service Ratio (DSR) 60%

- Total Income RM3,001 – RM5,000: DSR 70%

- Total Income > RM5,001+: DSR 80%

Loan Amount

- Loan Amount: RM10,000 – RM200,000 (customer must settle the old Coshare account if they have a Coshare loan under KFH fund).

Payment Period

- Payment Period: 2 – 10 years.

Application Form

You can download e-form and submit to us.

Documents

Kuwait Finance House (KFH) requires assembling a comprehensive set of documents. Here’s a detailed rundown of what you’ll need:

- Identification Documents: To kickstart the process, ensure you have a copy of your National Identity Card (IC), reflecting your current information. Additionally, if applicable, provide a colored copy of your police ID.

- Employment Verification: Demonstrating your employment status is crucial. Access to ANM (Angkatan Tentera Malaysia) & HRMIS (Human Resource Management Information System) is necessary, especially for police officers who must procure their HRMIS printouts.

- Payroll Bank Account: An essential component of your application is a copy of your payroll bank account statement. This documentation is mandatory and aids in assessing your financial standing.

- Age Verification: For individuals aged 43 and above, an option letter is required to confirm your eligibility and intent to proceed with the loan application.

- Confirmation Letter: Solidify your application with a confirmation letter affirming your employment or income status. This letter acts as a testament to your financial stability and commitment to fulfilling the loan obligations.

Gather these documents meticulously, ensuring they are complete, up-to-date, and readily accessible. By adhering to these requirements, you pave the way for a seamless loan application process with Kuwait Finance House, propelling you closer to achieving your financial aspirations.

2024 KFH Penjawat Awam

Mohon pinjaman peribadi KFH khas untuk penjawat awam dengan DSR sehingga 95%. Payout tinggi 94.97%. Interest 4.50%-4.65%. Tawaran terhad mohon sekarang!

Terma dan Syarat

Syarat-syarat untuk mendapat kelulusan KFH adalah seperti berikut:

- Warga negara yang berkhidmat di bawah kerajaan persekutuan

- Umur 21- 57 tahun

- Tidak ada rekod ctos

- Jumlah potongan di bawah 60% yg dibenarkan

- Komitmen boleh diterima sehingga DSR 95%

- Sila WhatsApp slip gaji terkini utk semak kelayakan anda.

Perhatian: Bagi pemohon yang bekerja sebagai seorang cikgu cuma print out 4 borang KFH yang perlukan tandatangan sahaja dan tidak perlu isi borang. Dokumen yang diperlukan adalah:

- Page 4

- Form 1

- Form 2

- Form 3

** Boleh WhatsApp dengan format pdf ataupun boleh sign online sahaja.

Dokumen Diperlukan

Dokumen yg diperlukan untuk memohon pinjaman peribadi KFH Penjawat Awam adalah seperti berikut:

- IC depan/belakang berwarna yang jelas.

- Password e- penyata

- Password HRMIS

- Surat Pengesahan majikan.

- Nombor akaun bank yang masuk gaji dalam slip gaji

* Semua dokumen di atas boleh dihantar menggunakan WhatsApp.

Info Diperlukan dalam Borang KFH

Info yang diperlukan dalam borang pemohon adalah seperti berikut:

| Kategori | Maklumat |

|---|---|

| Nama Penuh | |

| No I/C | |

| Alamat Tetap | |

| Alamat Sekarang | |

| No Tel Bimbit | |

| Bilangan Tanggungan | |

| Taraf Perkahwinan | |

| Bangsa | |

| Agama | |

| Taraf Pemilikan Rumah | |

| Pendidikan Tertinggi | |

| Alamat Email | |

| Nama Ibu | |

| Tempoh Menetap (Tahun/Bulan) | |

| Dengan ini saya bersetuju dengan semua syarat-syarat yang telah diberitahu oleh Pegawai Pemasaran dan mengesahkan semua maklumat yang diberikan adalah benar. Terima kasih. | |

| Kategori | Maklumat |

|---|---|

| Maklumat Pasangan | |

| Nama Penuh Pasangan | |

| No I/C Pasangan | |

| Tarikh Lahir Pasangan | |

| No Tel. Bimbit Pasangan | |

| Nama Majikan Pasangan | |

| Alamat Penuh Majikan Pasangan | |

| Gaji Pasangan | |

| Tarikh Mula Berkhidmat Pasangan | |

| No. Tel Pejabat Pasangan | |

| Dengan ini saya bersetuju dengan semua syarat-syarat yang telah diberitahu oleh Pegawai Pemasaran dan mengesahkan semua maklumat yang diberikan adalah benar. Terima kasih. | |

| Kategori | Maklumat |

|---|---|

| Maklumat Rujukan Saudara Terdekat | |

| Nama Penuh | |

| Nombor I/C | |

| Alamat Tetap | |

| No Tel. Bimbit | |

| Pertalian Dengan Pemohon | |

| Pekerjaan | |

| Dengan ini saya bersetuju dengan semua syarat-syarat yang telah diberitahu oleh Pegawai Pemasaran dan mengesahkan semua maklumat yang diberikan adalah benar. Terima kasih. | |

Muat Turun Borang

Download Jadual Pembayaran

Sila download jadual pembayaran bagi pinjaman peribadi KFH dibawah:

Jadual Pembayaran KFH untuk kakitangan awam

Download Borang

Berikut adalah borang loan KFH (Kuwait Finance House) untuk anda download seperti dibawah:

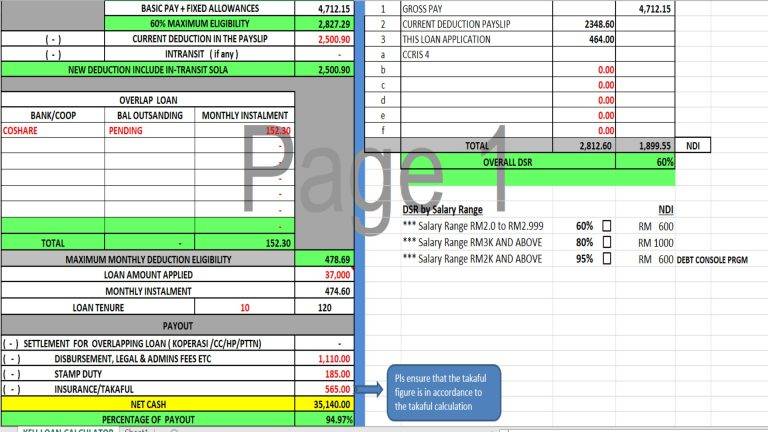

Cara Pengiraan Tunai Bersih Ditangan

Cara pengiraan loan KFH adalah seperti berikut:

- Gaji pokok campur dengan elaun tetap. Contohnya Rm4,712.15

- Jumlah potongan terkini dalam slipgaji. Contohnya RM2,500.90

- Adakah anda ada membuat pinjaman peribadi sebelum ini dan sudah lulus tetapi potongannya belum masuk lagi ke dalam payslip anda? Jika ada rekod intransit, anda harus campurkan bersama jumlah potongan terkini dalam payslip. Dalam contoh ini, tiada rekod in-transit ANGKASA bermakna jumlah potongan keseluruhan adalah RM2,500.00 (current deduction in the payslip+intransit ANGKASA)

- Adakah anda ingin overlap loan lama? Jika ya, sila sertakan surat penyata bank atau koperasi yang masih sah tempoh (validity) sekurang-kurangnya 1 bulan. Dalam kes ini, terdapat loan COSHARE yang perlu dioverlap. Installment bulanan adalah RM152.30. Jadi, jumlah lebihan pendapatan yang dibenarkan untuk pohon pinjaman peribadi adalah RM478.69.

- Max loan tenure adalah 10 tahun. Jadi jumlah maksima amaun pinjaman peribadi yang boleh dipohon adalah RM37,000 selama 120 bulan (10 tahun) dan bayaran bulanan atau monthly installement adalah RM474.60.

- Jadi berapakah amaun bersih (nett payment) yang akan anda dapat nanti? Untuk loan Kuwait Finance House ini, payout adalah 94.97%. Maknanya, jumlah loan RM37,000 dan selepas ditolak payout, maka anda akan mendaapt nett payout RM35,140.00

* Sila ambil perhatian bahawa jumlah nett payout loan KFH ini belum ditolak dengan jumlah full settlement loan COSHARE yang masih pending amaunnya. Sekiranya jumlah full settlement COSHARE adalah %M15,000 setelah ditolak ibra atau rebate, maka anda akan dapat tunai bersih ditangan sebanyak RM20,140.00

** Sekiranya anda tidak ada sebarang pinjaman peribadi untuk dilakukan overlap, maka anda akan dapat tunai bersih ditangan sebanyak RM35,140.00

Sila hubungi kami di talian untuk sebarang pertanyaan mengenai perkara ini. Anda boleh membuat kiraan sendiri, mencetak borang dan terus WhatsApp ke nombor hotline kami sekarang. Dapat borang lengkap, kami akan terus proses borang dan tanpa lengah-lengah lagi.

Mengapa Anda Perlu Mohon?

Mengapa anda perlu memohon 2024 pinjaman peribadi Kuwait Finance House KFH ini?

Terdapat banyak sebab utama untuk anda memohon pinjaman peribadi KFH yang sangat istimewa ini. Diantaranya adalah:

- DSR sehingga 95%: Tiada masalah jika komitmen luar payslip dengan dalam slipgaji anda tinggi kerana DSR yang dibenarkan adalah sehingga 95%.

- Interest tetap atau Flat RATE: Interest tetap iaitu 4.65% selama 10 tahun jadi bayaran anda tetap sama. Anda tidak akan terperanjat apabila mendapati secara tiba-tiba ansuran bulanan anda meningkat kepada 10% atau 20% dari ansuran bulanan tahun lepas.

- Proses loan tanpa pengesahan majikan: Anda tidak perlu mendapatkan cop pengesahan jawatan untuk borang ANGKASA dan dokumen sokongan lain seperti slipgaji, salinan IC, buku bank dan sebagainya kerana pinjaman dari KFH ini tidak memerlukan pengesahan majikan.

- Agen bank dan koperasi yang dipercayai: Dengan memohon pinjaman peribadi bank dan koperasi dengan kami, kami adalah berpengalaman lebih 15 tahun dalam bidang ini. Hubungi kami sekarang.

- Telus dan dipercayai: Kami tidak menyembunyikan apa-apa kos kerana semua keterangan mengenai pembiayaan peribadi KFH ini ada disiarkan dalam laman web ini.

- Cepat dan tangkas: Anda tidak perlu tunggu kami kirakan untuk anda. Anda boleh buat pengiraan sendiri berdasarkan formula pengiraan yang ditunjukkan dan terus sertakan dokumen seperti yang diminta. Hantar terus melalui WhatsApp semua borang dan dokumen lengkap dan kami akan uruskan dengan secepat mungkin.

Contact Kuwait Finance House (Malaysia)

Kuwait Finance House (Malaysia) Berhad

Level 26, Menara Prestige

1, Jalan Pinang,P.O.Box 10103

50450 Kuala Lumpur, Malaysia.

Telephone:

- 1 300 888 KFH (534) – Kuwait Finance House (KFH)

- Kuwait Finance House (KFH) International Hotline – Telephone: 603-2168 0464

Kuwait Finance House: Summary

- Article Title: Kuwait Finance House

- Category: #Bank #pinjamanperibadi #KFH

- Purpose: #GeneralInformation

- Source: Maklumat Agen official website

Bank Personal Loans

Looking for the best bank personal loans? Explore our offers with competitive interest rates, an easy application process, and fast approval. Click below to view your options and find the loan that suits your financial needs!

UOB Bank: Best Personal Loans in Malaysia

UOB Bank Experience the convenience and empowerment of UOB Bank’s personal loans, designed for hassle-free borrowing. With transparent terms, competitive rates, and exceptional service, UOB...

RHB Bank: Best Personal Loans in Malaysia

RHB Bank Looking to achieve your financial goals and unlock greater flexibility? Explore RHB Bank’s diverse range of personal financing solutions designed to cater to...

OCBC Bank: Best Personal Loans in Malaysia

OCBC Bank OCBC Bank offers additional financial support on top of your housing loan. Access up to RM150,000 for personal use, tailored to your needs....

Web Directories

Find the best resources tailored to your interests! Whether you’re searching for travel ideas, money-saving tips, fun hobbies, or trusted product reviews, we’ve got you covered. Our carefully curated recommendations help you discover new experiences and make informed decisions—effortlessly. Start exploring today!

- https://asiaworldtour.com: “Asia World Tour: Your Gateway to Asian and World Adventures”

- https://personalfinancingloan.com: “Personal Financing Loan: Your Path to Financial Freedom”

- https://hobbyforte.com: “HobbyForte: Discover Your Car Passion, Explore Your Interests”

- https://reviewsanything.com: “ReviewsAnything: Your Trusted Source for Honest Gadget Reviews”

- https://rumahmampumilik.com: “Rumah Mampu Milik: Your Affordable Homeownership Journey Begins Here”

- https://malaysiadigit.com: “MalaysiaDigit: Your Digital Destination for News and Insights”

- https://vipmalaysia.com: “VIP Malaysia: Elevate Your Experience in Malaysia”

- https://nordiyana.com: “Indulge in Elegance at Nordiyana: Latest Recipe and Culinary Inspirations”

- https://e-penyatagaji.com: “E-Penyata Gaji: Simplifying Payroll Management for You”

- https://googleasia.org: “Google Asia: Explore the World and Asia’s Wonders with Google Asia”

- https://malaysiafit.com: “Malaysia Fit: Your Partner in Health and Wellness”

- https://koperasi.info: “Koperasi: Building Communities, Empowering Lives”

- https://recipeinside.com: “RecipeInside: Unveiling Culinary Creations, Your Guide to Delicious Dishes”

- https://asiahealthcenter.com: “Asia Health Center: Your Source for Holistic Wellness Solutions”

- https://nationalhealthcenters.com: “National Health Centers: Your Source for Vital Health Information and Community Care”

- https://malaysiabit.com: “MalaysiaBit: Stay Informed, Stay Connected”

- https://epenyatagaji.com: “E-Penyata Gaji: Your Digital Payslip Solution”

- https://koperasi.work: “Koperasi Work: Collaborate, Innovate, Succeed”

- https://koperasi.business: “Koperasi Business: Driving Entrepreneurship, Fostering Growth”