Maybank Discover boundless financial opportunities through Maybank’s personal loan solutions. Embrace a future of prosperity with our competitive rates and lightning-fast approvals. Don’t miss out,...

Bank Muamalat Malaysia Berhad (BMMB)

Looking for flexible and Sharia-compliant personal loan solutions? Look no further than Bank Muamalat Malaysia Berhad. Our offerings are tailored to suit your financial needs, empowering you to achieve your goals with competitive rates and a hassle-free application process. Whether you’re planning for a major purchase or need assistance with unexpected expenses, Bank Muamalat is here to support you on your financial journey. Discover the convenience and peace of mind that comes with our personalized loan options today.

Pioneering Islamic Banking in Malaysia

A Trailblazer in Islamic Finance

Established in 1999, Bank Muamalat Malaysia Berhad (BMMB) holds the distinction of being one of Malaysia’s foremost Islamic banks. It earned this reputation by offering an extensive array of Sharia-compliant financial products and services. Notably, BMMB made history as the first Islamic bank to receive a full banking license under the Islamic Banking Act 1983, laying the groundwork for the development of Islamic finance in Malaysia.

Operating on Sharia Principles

At its core, Bank Muamalat operates in accordance with the principles of Sharia, ensuring that all its operations and offerings align with Islamic law. This commitment involves steering clear of interest (riba), engaging in ethical investments, and promoting risk-sharing between the bank and its customers.

Tailored Financial Solutions

Bank Muamalat caters to the diverse needs of its clientele by providing a wide range of financial solutions. These include personal financing options, savings and current accounts, investment products, and wealth management services. Its personal financing products are structured to assist individuals in various financial endeavors, such as home renovations, education expenses, vehicle purchases, and debt consolidation, all while adhering to Islamic financing principles.

Nationwide Accessibility and Customer Service Excellence

With a comprehensive network of branches and electronic banking channels, Bank Muamalat ensures convenient access to its services across Malaysia. This commitment to accessibility underscores its dedication to serving customers from different regions. Moreover, the bank prioritizes excellent customer service, delivering efficient and reliable banking solutions to enhance the financial well-being of its clientele.

Contributing to Industry Advancement

Bank Muamalat’s influence transcends traditional banking services. Actively involved in industry initiatives, the bank plays a pivotal role in advancing Islamic finance in Malaysia and beyond. It actively promotes financial literacy, collaborates with stakeholders, and contributes to the growth and sustainability of Islamic banking.

Personal Financing-i

For Armed Forces

At Bank Muamalat Malaysia Berhad (BMMB), we offer enticing deals for personal loans tailored to suit your needs. Benefit from competitive rates, flexible terms, and a hassle-free application process. Empower your financial journey with us today.

Bank Muamalat Personal Financing-i For Armed Forces:

Products / Items | Investment and Refinancing (Armed Forces) | ||||||||||||

Purpose | Settlement of Debt and Investment | ||||||||||||

Who Can Apply | Malaysia Armed Forces | ||||||||||||

Tenure | Minimum: 3 years, Maximum: 10 years* | ||||||||||||

Financing Amount | Minimum: RM 5,000.00 Maximum: RM 100,000.00 | ||||||||||||

Profit Rate | Flat: 5.5% p.a Floating: BFR+1.8% (capping rate 11%) | ||||||||||||

Mode of Payment | Auto Debit net salary via BMMB Current/Saving Account | ||||||||||||

Wasiat/Will – writing | Optional | ||||||||||||

Takaful | Compulsory | ||||||||||||

Guarantor | Not available | ||||||||||||

Documents Required |

| ||||||||||||

Applicant’s Eligibility | a) Age:

| ||||||||||||

Government & Related Agencies Staff

Bank Muamalat Financing products:

Products / Items | Financial Management Financing – PPK Invesment and Refinancing | ||||||||||||

| Civilian | |||||||||||||

Purpose | Settlement of Debt and Investment | ||||||||||||

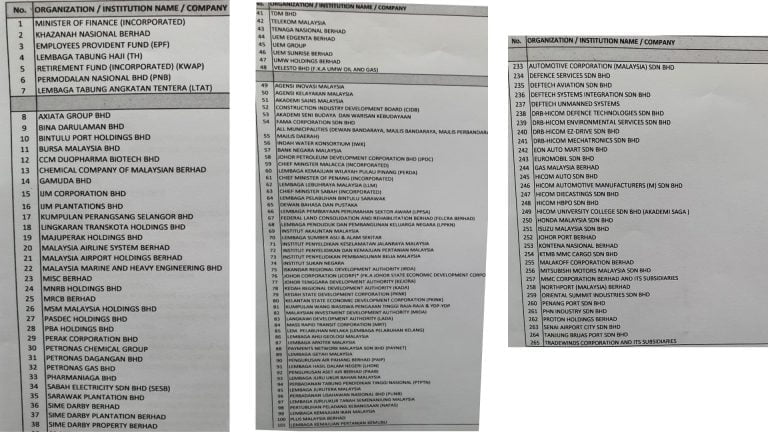

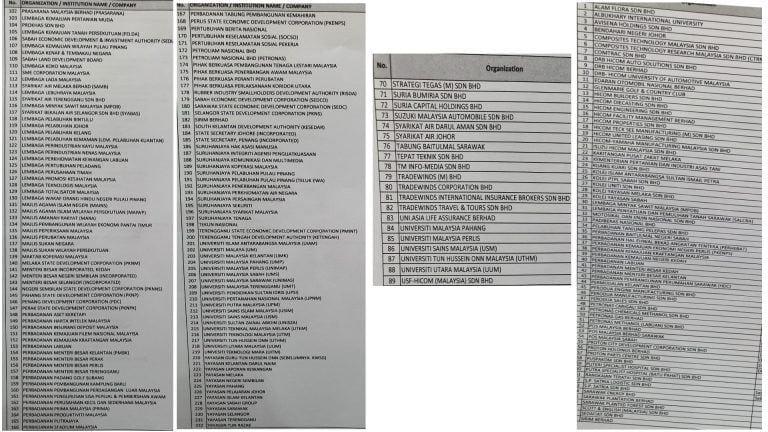

Who Can Apply | All Federal / State Government/Government. Link Company/Selected Organizations staff | ||||||||||||

Tenure | Minimum: 3 years. Maximum: 10 years | ||||||||||||

Financing Amount | Minimum: RM 5,000.00. Maximum: RM 100,000.00 | ||||||||||||

Profit Rate | Flat: Without Ju’alah: 5.5% p.a, With Ju’alah: 5.7% p.a. Floating: BFR+1.8% (capping rate 11%) | ||||||||||||

Mode of Payment | a) Auto Debit net salary via BMMB Current/Saving Account or. b) Salary deduction At Source by employer | ||||||||||||

Wasiat/Will – writing | Optional | ||||||||||||

Takaful | Compulsory | ||||||||||||

Guarantor | Not available | ||||||||||||

Documents Required |

| ||||||||||||

Applicant’s Eligibility |

|

Note:

- Customer’s not a Bankruptcy during apply Bank Muamalat Malaysia Berhad BMMB financing

- Terms and conditions apply

Selected Organizations Staff

Products / Items | Investment and Refinancing (Civilian – Selected Organization) | ||||||||||||

Purpose | Setlement of Debt and Investment | ||||||||||||

Who Can Apply | Selected organizations staff | ||||||||||||

Tenure | Minimum: 3 years. Maximum: 10 years | ||||||||||||

Financing Amount | Minimum: RM 5,000.00. Maximum: RM 150,000.00 (Floating Rate), RM 100,000.00 (Flat Rate) | ||||||||||||

Profit Rate | Flat: Without Ju’alah: 5.5% p.a, With Ju’alah: 5.7% p.a. Floating: BFR+1.8% (capping rate 11%) | ||||||||||||

Mode of Payment | a) Auto Debit net salary via BMMB Current/Saving Account or b) Salary deduction At Source by employer | ||||||||||||

Wasiat/Will – Writing | Compulsory | ||||||||||||

Takaful | Compulsory | ||||||||||||

Guarantor | Not available | ||||||||||||

Documents Required |

|

Note:

- Customer’s not a Bankruptcy during apply Bank Muamalat Malaysia Berhad BMMB financing

- Terms and conditions apply

Financial Initiatives

Muamalat Invest: Driving Islamic Investment Excellence

Muamalat Invest Sdn Bhd (“MISB”) is a trusted subsidiary of Bank Muamalat Malaysia Berhad. As a licensed Islamic fund manager since 2006, we prioritize ethical and Shariah-compliant investment solutions tailored to meet your financial goals.

Empowering Economic Prosperity through Wakaf Muamalat

Wakaf Muamalat has been instrumental in promoting economic prosperity through various collaborations and synergies since 2012. With over RM 26.7 million collected to date, Wakaf Muamalat ensures that the needy and underprivileged are supported and cared for. Explore the endless opportunities of wakaf with us today!

Jariah Fund: Empowering the Underprivileged

Jariah Fund serves as an online crowdfunding platform dedicated to assisting the underprivileged and contributing to societal welfare. With transparent features, including real-time updates on funds collected and beneficiary status, Jariah Fund makes it easier than ever to make a difference in the lives of those in need.

Pembiayaan Peribadi Pesara (3P)

Bank Muamalat offers a range of flexible and convenient personal financing solutions tailored to meet the diverse needs of its customers. With competitive rates and transparent terms, customers can easily access the funds they need to achieve their financial goals.

Structured Personal Financing-i

One of the primary financing options available is the Structured Personal Financing-i, designed to provide individuals with financial flexibility and peace of mind. With a minimum financing period of 2 years and a maximum of 10 years, customers can choose a repayment tenure that suits their budget and requirements. Additionally, customers can access financing of up to RM250,000*, making it ideal for various purposes such as home renovations, education expenses, or emergency funds.

Pembiayaan Peribadi Pesara (3P)

For customers who are retired or nearing retirement, the Pembiayaan Peribadi Pesara (3P) offers a dedicated financing solution tailored to their needs. With a competitive profit rate of 5.50% per annum and flexible repayment tenures ranging from 3 to 10 years, retirees can access financing amounts ranging from RM5,000.00 to RM250,000.00 to support their post-retirement lifestyle.

Customers also have the option to enhance their financial security by opting for additional services such as will-writing and takaful coverage, providing added peace of mind for themselves and their loved ones.

In summary, Bank Muamalat’s personal financing solutions offer flexibility, affordability, and accessibility, making them an ideal choice for individuals looking to fulfill their financial needs and aspirations.

Personal Financing-i Programme: Flexible Financing Solutions

Bank Muamalat’s Personal Financing-i programme offers individuals a convenient and flexible way to access financing for their various needs. With a minimum financing period of 2 years and a maximum of 10 years, customers have the flexibility to choose a repayment tenure that suits their financial situation. The programme allows financing of up to RM250,000*, making it suitable for a wide range of purposes, such as home renovations, education expenses, or emergency funds.

Accessibility for All Ages

One of the key advantages of Bank Muamalat’s Personal Financing-i programme is its accessibility. Individuals up to 70 years old* can apply for financing, providing opportunities for retirees and seniors to access much-needed funds for their financial needs. Moreover, the programme does not require a guarantor, streamlining the application process and reducing administrative hassle for customers.

Transparent and Affordable Financing

Customers can also benefit from the transparency and affordability of the programme, as there are no processing fees or hidden charges involved. This ensures that customers can borrow with confidence, knowing that they will not encounter any unexpected costs throughout the financing tenure.

Cash-i Muamalat: Tailored for Government Employees

Additionally, Bank Muamalat offers the Cash-i Muamalat programme specifically tailored for government employees, government-linked companies (GLCs), government-linked investment companies (GLICs), and employers under the empanelment programme. With a competitive profit rate of $485 per annum, eligible individuals aged 18 and above can access financing up to 60 years old or up to retirement age (whichever is earlier). Malaysian citizenship is required, and specific eligibility criteria apply based on employment status and income level.

(*Subject to terms and conditions)

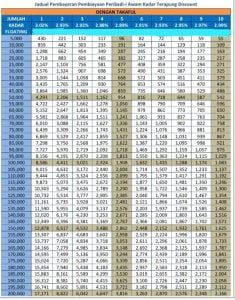

Repayment Schedule for Pesara Personal Financing-i

This repayment schedule outlines the payment plan for Bank Muamalat Pesara Personal Financing-i, providing clarity and transparency for borrowers. Understanding the repayment schedule is crucial for managing finances effectively and ensuring timely payments.

Bank Muamalat’s Personal Loan Repayment Schedule for Military Veterans & Government Employees features a fixed profit rate of 5.50%. This schedule outlines payment details, facilitating responsible financial planning and management.

| Loan Amount (RM) | 1 Year | 2 Years | 3 Years | 4 Years | 5 Years | 6 Years | 7 Years | 8 Years | 9 Years | 10 Years |

|---|---|---|---|---|---|---|---|---|---|---|

| 10,000 | 879 | 463 | 324 | 254 | 213 | 185 | 165 | 150 | 138 | 129 |

| 20,000 | 1,758 | 925 | 647 | 508 | 425 | 369 | 330 | 300 | 277 | 258 |

| 30,000 | 2,638 | 1,388 | 971 | 763 | 638 | 554 | 495 | 450 | 415 | 388 |

| 40,000 | 3,517 | 1,850 | 1,294 | 1,017 | 850 | 739 | 660 | 600 | 554 | 517 |

| 50,000 | 4,396 | 2,313 | 1,618 | 1,271 | 1,063 | 924 | 824 | 750 | 692 | 646 |

| 60,000 | 5,275 | 2,775 | 1,942 | 1,525 | 1,275 | 1,108 | 989 | 900 | 831 | 775 |

* Any changes to the financing repayment are subject to terms and conditions.

Takaful and Shariah Concepts

Bank Muamalat’s Personal Financing-i (Tawarruq) is a Shariah-compliant financing facility designed to provide cash financing for personal use without violating Shariah principles. This article explores the underlying Shariah concepts and structures employed in this financing product.

Tawarruq: The Core Concept

Tawarruq serves as the fundamental Shariah concept underlying Bank Muamalat’s Personal Financing-i. It involves two sale and purchase contracts: the first sale of an asset on a deferred basis followed by the sale of the same asset to a third party on a cash basis. This arrangement ensures compliance with Islamic principles while facilitating cash financing for customers.

Murabahah: Transparency in Transactions

Murabahah is a key component of the financing structure, representing a sale and purchase transaction where the acquisition cost and markup are disclosed to the purchaser. This transparency ensures that customers are fully informed about the terms and conditions of their financing, aligning with Islamic ethical principles.

Wakalah: Delegated Authority

Wakalah plays a vital role in Bank Muamalat’s financing framework, representing a contract where one party authorizes another as their agent to perform specific tasks. This delegated authority ensures efficient and effective management of customer transactions within the boundaries of Shariah law.

Wa’d: Commitment for the Future

Wa’d involves a commitment given by one party to another to perform certain actions in the future. In the context of Bank Muamalat’s financing, Wa’d provides assurance to customers regarding future transactions, enhancing trust and confidence in the Shariah-compliant nature of the product.

Bai’ Wadhi’ah: Ethical Pricing

Bai’ Wadhi’ah represents a sale contract where the asset or commodity is sold at a price lower than the cost incurred by the customer. This ethical pricing mechanism ensures fairness and equity in transactions, reflecting the Islamic principles of justice and compassion.

In summary, Bank Muamalat’s Personal Financing-i (Tawarruq) adheres to Shariah principles through the careful application of Tawarruq, Murabahah, Wakalah, Wa’d, and Bai’ Wadhi’ah contracts. By incorporating these concepts, Bank Muamalat ensures transparency, fairness, and ethical conduct in its financing activities, providing customers with Shariah-compliant solutions for their financial needs.

Exclusive Financing Offers (Limited Time Only)

Employees of PR1MA Malaysia Corporation, Venture Tech, HDC, MBSB Bank, and Port Klang Malaysia are in for a treat with exclusive financing rates tailored just for them. Take advantage of these special offers:

- Best Bank Muamalat Financing: Access the best financing solutions from Bank Muamalat, with maximum loan amounts of up to RM400,000. Whether you’re looking to purchase a home, a vehicle, or meet other financial needs, Bank Muamalat has you covered.

- Extended Financing Period: Enjoy flexibility with financing periods of up to 10 years, allowing you ample time to repay your loans comfortably and without stress.

- Mortgage with Up to 100% Financing: Fulfill your dreams of homeownership with mortgage options offering up to 100% financing. Say goodbye to hefty down payments and embrace the convenience of securing your dream home with ease.

- Vehicle Financing Products with Up to 100% Financing: Drive away with your desired vehicle without breaking the bank. Benefit from vehicle financing products offering up to 100% financing, ensuring that you can hit the road with confidence and peace of mind.

Don’t miss out on these exclusive offers designed to cater to your unique financial needs. Whether it’s owning a home or purchasing a vehicle, Bank Muamalat is here to support you every step of the way. Unlock your financial potential and seize these special rates today!

Contact Bank Muamalat Malaysia Berhad (BMMB)

Bank Muamalat Malaysia Berhad

Ibu Pejabat, Menara Bumiputra, 21 Jalan Melaka,

50100 Kuala Lumpur

Call Center +603-2600 5500

BMMB: Summary

- Article Title: BMMB

- Category: #Bank #PersonalLoan #BMMB

- Purpose: #GeneralInformation

- Source: bankmuamalat.com.my official website

Frequently Asked Questions (FAQ)

Find answers to common questions in our FAQ section. Whether you need help, guidance, or quick tips, we’ve got the information you need! Browse our expert responses and get the solutions you’re looking for—fast and easy.

Bank Personal Loans

Looking for the best bank personal loans? Explore our offers with competitive interest rates, an easy application process, and fast approval. Click below to view your options and find the loan that suits your financial needs!

UOB Bank: Best Personal Loans in Malaysia

UOB Bank Experience the convenience and empowerment of UOB Bank’s personal loans, designed for hassle-free borrowing. With transparent terms, competitive rates, and exceptional service, UOB...

RHB Bank: Best Personal Loans in Malaysia

RHB Bank Looking to achieve your financial goals and unlock greater flexibility? Explore RHB Bank’s diverse range of personal financing solutions designed to cater to...

OCBC Bank: Best Personal Loans in Malaysia

OCBC Bank OCBC Bank offers additional financial support on top of your housing loan. Access up to RM150,000 for personal use, tailored to your needs....

Web Directories

Find the best resources tailored to your interests! Whether you’re searching for travel ideas, money-saving tips, fun hobbies, or trusted product reviews, we’ve got you covered. Our carefully curated recommendations help you discover new experiences and make informed decisions—effortlessly. Start exploring today!

- https://asiaworldtour.com: “Asia World Tour: Your Gateway to Asian and World Adventures”

- https://personalfinancingloan.com: “Personal Financing Loan: Your Path to Financial Freedom”

- https://hobbyforte.com: “HobbyForte: Discover Your Car Passion, Explore Your Interests”

- https://reviewsanything.com: “ReviewsAnything: Your Trusted Source for Honest Gadget Reviews”

- https://rumahmampumilik.com: “Rumah Mampu Milik: Your Affordable Homeownership Journey Begins Here”

- https://malaysiadigit.com: “MalaysiaDigit: Your Digital Destination for News and Insights”

- https://vipmalaysia.com: “VIP Malaysia: Elevate Your Experience in Malaysia”

- https://nordiyana.com: “Indulge in Elegance at Nordiyana: Latest Recipe and Culinary Inspirations”

- https://e-penyatagaji.com: “E-Penyata Gaji: Simplifying Payroll Management for You”

- https://googleasia.org: “Google Asia: Explore the World and Asia’s Wonders with Google Asia”

- https://malaysiafit.com: “Malaysia Fit: Your Partner in Health and Wellness”

- https://koperasi.info: “Koperasi: Building Communities, Empowering Lives”

- https://recipeinside.com: “RecipeInside: Unveiling Culinary Creations, Your Guide to Delicious Dishes”

- https://asiahealthcenter.com: “Asia Health Center: Your Source for Holistic Wellness Solutions”

- https://nationalhealthcenters.com: “National Health Centers: Your Source for Vital Health Information and Community Care”

- https://malaysiabit.com: “MalaysiaBit: Stay Informed, Stay Connected”

- https://epenyatagaji.com: “E-Penyata Gaji: Your Digital Payslip Solution”

- https://koperasi.work: “Koperasi Work: Collaborate, Innovate, Succeed”

- https://koperasi.business: “Koperasi Business: Driving Entrepreneurship, Fostering Growth”