Debt Management Discover the path to financial peace through effective debt management strategies. Stay on top of payments, manage bills, and budget for the future...

Secure a Personal Loan from a Cooperative

Discover 10 easy steps to secure a personal loan from a Cooperative, especially if you’re worried about scams or unfavorable loans. This guide will help you review, analyze, and make wise decisions before proceeding, ensuring you avoid getting trapped in difficult-to-repay debt.

Instant Loan Approval Process

Unlock the secrets to obtaining a personal loan from a cooperative with confidence and ease. This comprehensive guide is tailored to help you avoid scams and unfavorable loan conditions. Follow these steps to meticulously review, analyze, and make prudent financial decisions, ensuring you stay clear of burdensome debt.

- Research Cooperative Options: Begin by conducting thorough research on various cooperatives. Look for reputable organizations with positive reviews, high customer satisfaction ratings, and transparent lending practices. Check online forums, ask for recommendations from trusted sources, and consult consumer protection agencies for reliable information.

- Check Eligibility Requirements: Each cooperative has its own set of membership and loan eligibility criteria. Ensure you meet these requirements before applying. This may include being a member for a certain period, having a minimum income level, or fulfilling specific credit score criteria.

- Compare Loan Offers: Not all loan offers are created equal. Take the time to compare interest rates, repayment terms, processing fees, and other charges from multiple cooperatives. Use online comparison tools and speak directly with loan officers to get detailed information.

- Prepare Necessary Documentation: Gather all the required documents well in advance to streamline the application process. Typically, you will need proof of income, identification, recent bank statements, and, if applicable, documents related to any collateral you are offering.

- Understand Loan Terms: Before signing any agreement, thoroughly read and understand the loan terms. Pay special attention to the interest rate, repayment schedule, penalties for late payments, and any clauses related to early repayment or default.

- Evaluate Repayment Ability: Perform a detailed assessment of your financial situation. Calculate your monthly expenses and compare them with your income to ensure you can comfortably manage the loan repayments. Consider creating a budget to plan your finances better.

- Beware of Scams: Stay alert to potential scams. Red flags include guaranteed approval regardless of credit history, requests for upfront fees, pressure to act quickly, and offers that seem too good to be true. Verify the cooperative’s credentials and read reviews from other borrowers.

- Consult Financial Advisors: If you are unsure about any aspect of the loan or need professional advice, consult with a financial advisor. They can provide unbiased guidance and help you understand the long-term implications of the loan.

- Submit Your Application: When you are ready, complete and submit your loan application accurately. Provide all requested information truthfully to avoid delays or rejection. Double-check your application for any errors before submission.

- Review and Sign the Agreement: Once your loan is approved, take the time to review the final loan agreement thoroughly. Ensure that all the terms match what was initially discussed and agreed upon. Seek clarification on any points you do not understand before signing the document.

Benefits of Choosing an Islamic Financing Package

If you previously used a conventional financing scheme, switching to an Islamic financing package can offer numerous advantages. Islamic financing is now the core focus of all cooperatives in Malaysia, primarily because most borrowers are Muslim and Malay. Here are the key benefits of opting for an Islamic financing package:

- No Double Profits: Unlike conventional loans, Islamic financing ensures that borrowers do not face the burden of double profits. This means that the lender cannot charge an excessive profit margin on top of the agreed-upon price, ensuring fairness and affordability.

- No Hidden Charges: Islamic financing emphasizes transparency and honesty. All charges and fees are clearly disclosed upfront, so borrowers are not surprised by hidden costs during the repayment period. This practice helps maintain trust between the lender and borrower.

- Interest-Free Financing: One of the fundamental principles of Islamic financing is the prohibition of interest (riba’). Instead of charging interest, Islamic financial products operate on profit-sharing, leasing, or other Sharia-compliant contracts, making them more ethical and just.

- Sale and Purchase Agreement: Islamic financing often involves a sale and purchase agreement, where the financial institution buys the asset and then sells it to the borrower at a profit margin. This ensures that the transaction is based on tangible assets and real economic activity, aligning with Islamic principles.

- No Element of Riba’: Islamic financing strictly avoids any element of riba’ (usury), ensuring that all financial dealings are compliant with Sharia law. This adherence to ethical guidelines ensures that the financing is just and equitable for both parties involved.

- Transparent Process: The process of obtaining Islamic financing is transparent and straightforward. Borrowers are informed of all terms and conditions before entering into the agreement, promoting clarity and understanding.

Other Factors

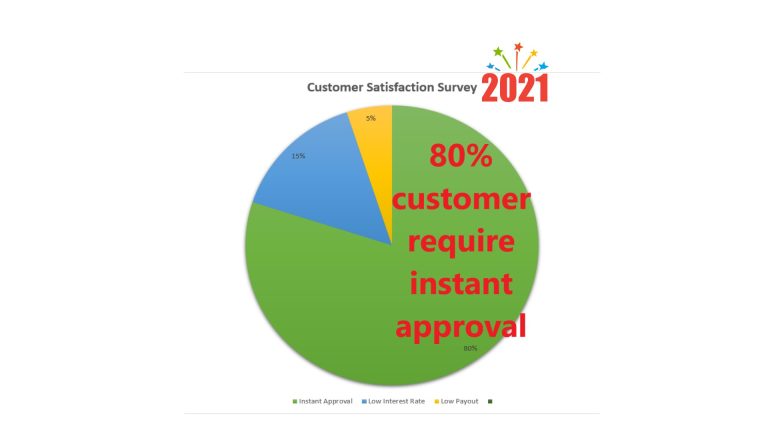

Low Interest or Fast Process?

Before proceeding with your cooperative personal loan application, carefully consider your immediate financial requirements. If you have the luxury of time and prioritize securing a low-interest loan, opt for that route. However, in cases of urgency where quick access to funds is imperative, prioritize a fast process. Balancing your need for affordability with the urgency of your situation will guide you towards the most suitable loan option.

Assessing Cooperative Loan

Before diving into your cooperative personal loan application, take a moment to assess your immediate financial needs. Depending on your circumstances, you may have different priorities to consider. Here’s a step-by-step approach to help you navigate through the decision-making process:

Step 1: Assess Your Financial Needs Evaluate your current financial situation and determine the urgency of your requirements. If you have the luxury of time and prioritize securing a low-interest loan, consider opting for that route. However, if quick access to funds is imperative due to urgent needs, prioritize a fast loan process.

Step 2: Balance Affordability and Urgency Striking a balance between affordability and urgency is crucial. While you may prefer a low-interest loan, urgent situations may necessitate prioritizing a fast loan process, even if it means slightly higher costs. Consider your financial priorities and choose the option that best aligns with your immediate needs.

Step 3: Prioritize High Payout When selecting a cooperative personal loan, prioritize high payout over a high loan amount. Some loan products may offer substantial financing but minimal payout, which can be disadvantageous. Opting for a high payout ensures you receive a significant portion of the loan upfront, providing greater flexibility in managing your expenses.

Step 4: Consider Flexibility in Repayment Evaluate the flexibility offered in loan repayment terms. Look for options that allow you to tailor your repayment schedule according to your financial capacity. Flexible repayment terms can provide breathing room during challenging times and help you stay on track with your financial goals.

Step 5: Review Interest Rates and Fees Compare interest rates and fees associated with different loan options. While lower interest rates are desirable, be mindful of hidden fees or charges that may offset potential savings. Scrutinize the terms and conditions to ensure transparency and avoid any unpleasant surprises later on.

Step 6: Seek Professional Advice If you’re unsure about the best loan option for your situation, consider seeking advice from financial professionals or loan advisors. They can offer insights tailored to your specific circumstances and help you make informed decisions.

Step 7: Make a Well-Informed Decision After considering all factors, make a well-informed decision based on your priorities and financial goals. Remember that the right loan option is one that meets your immediate needs while aligning with your long-term financial objectives.

By following these steps, you can navigate through the process of selecting the most suitable cooperative personal loan for your needs, ensuring you make a decision that serves your financial well-being in the best possible way.

Promotions: Be Caution

Before you commit to a cooperative personal loan, it’s wise to explore the latest promotions available in the market. These promotions often come with enticing offers that can enhance your loan experience. Here’s how you can leverage promotions to your advantage:

- Stay Informed About Latest Promotions Keep yourself updated about the latest promotions offered by cooperatives and financial institutions. These promotions may include revised interest rates, expedited loan approval processes, and additional perks like bank fund transfers. Staying informed allows you to capitalize on the best deals available.

- Consult Trusted Agents or Consultants Reach out to a trusted cooperative agent or financial consultant for information on current promotions. They can provide tailored advice based on your specific needs and circumstances. By consulting professionals, you can gain valuable insights into the promotions that align with your financial goals.

- Review Promotional Details Carefully Before making a decision, carefully review the details of each promotion. Pay close attention to interest rates, loan terms, and any additional benefits offered. Compare different promotions to determine which one offers the most favorable terms for your loan.

- Contact Us for Inquiries For inquiries and promotional details, feel free to contact us. Our team is ready to assist you and provide the information you need to make an informed decision. Don’t hesitate to reach out and take advantage of the current promotions to secure the best possible terms for your cooperative personal loan.

By staying informed and exploring the latest promotions, you can ensure that you make the most of your cooperative personal loan, securing favorable terms that suit your financial needs and goals.

Prepare Loan Documents Early

To ensure a smooth and efficient cooperative personal loan application process, it’s crucial to prepare all required documents in a timely manner. Follow these steps to streamline the documentation process:

- Collect Essential Paperwork: Gather important documents such as your job confirmation letter, verified salary slips, clear copies of bank account details, and identification documents like your IC (Identification Card).

- Organize Documents: Arrange the collected documents in a single file or folder, following the specified order outlined by your cooperative. This organization will facilitate easy access and submission when required.

- Obtain Bank Statements: Request a 3-month bank statement from your salary bank ahead of time to preempt any potential delays in the application process. This proactive approach ensures that you have all necessary financial records ready for submission.

- Maintain Communication: Stay in touch with your cooperative agent or financial consultant to stay updated on document requirements and any certifications needed from your employer. Clear communication will help address any queries or concerns promptly.

Why You Should Get Cooperative Personal Financing

- Flexibility: With cooperative personal financing, you have the flexibility to find the best loan plan that meets your financial objectives and goals. You can tailor a loan plan to fit your budget and be able to make payments that fit comfortably within your monthly income.

- Low Interest Rates: Cooperatives provide interest rates that are some of the lowest in the market. Because they are non-profit businesses, they can pass on the savings they get from doing business with other co-ops to their customers. This means that you can get low interest rates with cooperative personal financing.

- Access to Funds: The cooperative personal financing process is simpler and faster than the process of seeking a loan from other sources, such as banks. Not only do the cooperatives offer low interest rates, but they also provide you with access to funds in the form of loan proceeds.

- Technological Advancements: The cooperatives have incorporated technology into their operations to streamline the process of personal financing. Through technology-enabled features and functionalities, you get to apply for a loan conveniently at the touch of a button.

- Limited or No Collateral: Cooperatives do not need any form of collateral when providing personal financing. This is great news for people who do not have any collateral or those who do not want to risk losing the collateral they have.

- Financial Education: Cooperatives provide financial education to their members, increasing the knowledge and understanding of how to use personal financing to their advantage.

- Payment Flexibility: With cooperative personal financing, you have the flexibility to make payments as it suits you. You can make smaller token payments or larger payments at once depending on your financial position.

- Loan Consolidation: If you have multiple high-interest loans, cooperative financing can help you consolidate them into one loan with a lower interest rate. This will help you save money in the long run.

- Guidance: You can receive counselling and guidance from cooperative employees. They are knowledgeable about your financial needs and can help guide you in the right direction.

- Network of Businesses: Through cooperative financing, you can access a network of businesses to purchase goods and services with low-interest payments. This can also help you save money compared to making purchases with cash or a credit card.

Frequently Asked Questions (FAQ)

Find answers to common questions in our FAQ section. Whether you need help, guidance, or quick tips, we’ve got the information you need! Browse our expert responses and get the solutions you’re looking for—fast and easy.

Securing a Cooperative Personal Loans: Summary

- Article Title: Securing a Cooperative Personal Loans

- Category: #FinancialManagement

- Purpose: #GeneralInformation

Financial Management

Need help with financial management? We offer a range of solutions to help you manage your finances smarter. Get tips, strategies, and services tailored to achieve financial stability. Click below to learn more and start your financial journey today!

Boost Your Savings: Best Practices & Benefits

Saving Learn practical strategies for saving money and securing your financial future. Discover sustainable habits that help you grow wealth while making smart, eco-conscious choices....

Bankruptcy Challenges: Strategies for Best Financial Rebirth!

Bankruptcy Explore why bankruptcy poses life challenges. Discover insights on overcoming difficulties and rebuilding financial resilience. Life Difficult Bankruptcy can make life difficult because it...

Easy Side Income: Multiply Your Earnings Today!

Side Income Discover simple yet effective strategies to unlock additional income streams effortlessly. Explore practical tips and easy-to-implement methods to boost your earnings and attain...

Web Directories

Find the best resources tailored to your interests! Whether you’re searching for travel ideas, money-saving tips, fun hobbies, or trusted product reviews, we’ve got you covered. Our carefully curated recommendations help you discover new experiences and make informed decisions—effortlessly. Start exploring today!

- https://asiaworldtour.com: “Asia World Tour: Your Gateway to Asian and World Adventures”

- https://personalfinancingloan.com: “Personal Financing Loan: Your Path to Financial Freedom”

- https://hobbyforte.com: “HobbyForte: Discover Your Car Passion, Explore Your Interests”

- https://reviewsanything.com: “ReviewsAnything: Your Trusted Source for Honest Gadget Reviews”

- https://rumahmampumilik.com: “Rumah Mampu Milik: Your Affordable Homeownership Journey Begins Here”

- https://malaysiadigit.com: “MalaysiaDigit: Your Digital Destination for News and Insights”

- https://vipmalaysia.com: “VIP Malaysia: Elevate Your Experience in Malaysia”

- https://nordiyana.com: “Indulge in Elegance at Nordiyana: Latest Recipe and Culinary Inspirations”

- https://e-penyatagaji.com: “E-Penyata Gaji: Simplifying Payroll Management for You”

- https://googleasia.org: “Google Asia: Explore the World and Asia’s Wonders with Google Asia”

- https://malaysiafit.com: “Malaysia Fit: Your Partner in Health and Wellness”

- https://koperasi.info: “Koperasi: Building Communities, Empowering Lives”

- https://recipeinside.com: “RecipeInside: Unveiling Culinary Creations, Your Guide to Delicious Dishes”

- https://asiahealthcenter.com: “Asia Health Center: Your Source for Holistic Wellness Solutions”

- https://nationalhealthcenters.com: “National Health Centers: Your Source for Vital Health Information and Community Care”

- https://malaysiabit.com: “MalaysiaBit: Stay Informed, Stay Connected”

- https://epenyatagaji.com: “E-Penyata Gaji: Your Digital Payslip Solution”

- https://koperasi.work: “Koperasi Work: Collaborate, Innovate, Succeed”

- https://koperasi.business: “Koperasi Business: Driving Entrepreneurship, Fostering Growth”